|

Of all modern occupations, one of the most picturesque is that of the speculator who makes fortunes in the great stock and grain exchanges of the world, loses them on an unfortunate turn, and with great fortitude and energy wins them back again. To the public that learns of this man and his life work, he appears with a certain glamor; but in general, he is considered merely a gamester, who bets on the turn of a market. Men of such a grade, however, are hardly worthy the dignified name of speculators. True, the speculator has in him above everything the gambling, instinct., but it is not by mere force of dollars and terrific gambling plunges, that the typical speculator wins immense fortunes. Here, as elsewhere, hard work only brings success. To the public it is only the spectacular side of the stock or grain market operator that appeals with force. But, back of the whirr of the grain pit or the stock post, must lie indefatigable study and application, a resourcefulness almost matchless, and a knowledge not only of the men with and against whom one is trading, but of every fiber of the fabric of the commercial and financial world. To the speculator the insignificant happenings of a day may mean much. The values of speculative commodities may be affected by the slightest turn in public sentiment over a political situation. A war cloud, even though it be as small as a man's hand may mean ruin or prosperity to him. These conditions all must be mastered both by a knowledge of them and their exact effect on lasting conditions, and by a knowledge of what opposing forces may develop from them. Probably the greatest manipulator of stocks in celebrated Wall street is a gentleman who has been twice a multi-millionaire, once a bankrupt for millions. Some men of the stock market desire to be identified closely with the companies whose stocks they manipulate, or buy and sell , up to hundreds of thousands of shares. Not so with this unique character. He is a manipulator pure and simple, one who by force of his large following of smaller speculators, and by his great foresight, can influence a market up or down by his plunges. To the layman, he simply bets on the rise or fall of the market quotations. To the initiated, however, it is upon faith in his knowledge of conditions that will influence the prices of stocks and bonds, that he makes his winnings. So far from being a stock gambler who bets on quotations, he can be called the one who makes quotations. Many times has he faced apparent defeat, and once he was ruined, as a result of trying to handle 1,000,000 bushels of wheat against his own judgment. At that time he showed the metal of which he was made. Falling from high life, he, a man used to luxury and the good things of the world, contented himself with a simple country house until by the same sagacity that made him rich once, he again became the envy of all speculators. There is another side of the speculator's life. While the fortunate ones are in the public eye and are heroes, there are others who have fallen in battle. It must be known, that while supply and demand and real intrinsic worth have much to do with the price at which the public buys and sells stocks, grains, cotton, etc., on the other hand, plunging, cornering a market and other kinds of manipulation, regardless of merit, may affect prices greatly. Thus we see times when one speculator, who is a "bull," has caught his arch-enemy "short," in such a manner that millions of dollars may be squeezed out of him. Men are prone to sell what they have not in their possession, trusting to conditions to depress prices and permit them to buy in at lower figures. But often this plan goes awry. The long line of "ghosts" of the stock brokers' offices, men who have been buffeted in the fight, and who still haunt the scenes of their former victories, testifies to this. Speculation is in some people a disease in the blood that mounts to the head. Men may be cool and calculating in speculation; they may bravely withstand defeat and plan other great coups, but they cannot get away from the sound of the ticker, or the excitement of the market, after having won or lost a fortune. TWO GREAT BUSINESS BODIES Stocks and bonds,—money-exchanges, boards of trade—these terms convey little meaning to the many. The general opinion prevails that dealings in the stock and grain markets savor of nothing but gambling. To much of the trading in the great exchanges of the world this stigma must attach. On the other hand, these great exchanges fill a needed want in commercial and financial life, for which America has of late years become so justly famous. Let us look into the character of the men and operations of these great markets, which send out their influence to every portion of the world. Of greatest influence in the country, financially, from the point of view of the speculator, are the operations on the New York Stock Exchange. This famous bourse is located in the short but widely known New York thoroughfare—Wall street—and is an association, of limited membership, made up of men who gain a livelihood by buying and selling securities, such as stocks and bonds of the great railway and industrial corporations of the country. In the majority of cases, the sale of these securities is for third parties, who, recognizing that the stock exchange is the trading place where such investments can be made, commission these brokers to transact their business for them. From this statement it may readily be drawn that in the beginning the stock exchange served simply as a convenient market-place where the best bargains could be made in the matter of investment of idle earnings. Such was the case, and the principal earnings of the brokers who were members of the exchange were from the commissions made from the sale or purchases of securities.

To the speculator on the rise and fall in stock prices is due the business of buying on margins. This has entailed an operation called "selling short," which is truly nothing but stock gambling. Operations on "margins" are the same as those cited in A's transactions save that instead of buying or selling the stocks or bonds outright, the business is done on a margin—that is the customer puts up about 10 per cent of the value of the stock traded in, and the broker lends the money at a fair rate of interest with which to complete the business. Thus "A" is able to buy heavily on a small capital. The trouble that often befalls a marginal trader is that in an erratic rise or fall of prices, the value of a stock may drop below or rise above the margin put up by the customer, in which event if more margins are not put up by him, the broker will close out the trade, and the customer loses the amount of the margin deposited. Short sales constitute selling bonds that one does not possess, trusting that conditions in the market will result in a depression of prices which will enable the seller to buy in the stock or bonds at a figure lower than the price at which they were sold short, thus giving the seller an ultimate profit. This sale is a contract to deliver to B by A a certain number of shares at a given price. Margins are also put up on short sales so that in case prices advance instead of declining the broker who sells for A and consequently has lent money with which to complete the transaction may be indemnified in a rising market. It might be well to define a number of phrases commonly used in financial circles, namely: A "bull" is a person who favors an advancing market or price of securities; the term is supposedly derived from the action of a bull in tossing things upward. A "bear" is one who favors lower prices; the term said to have resulted from the action of a bear in pressing its prey to the ground. A "slump" is a marked depression in prices. A "put" is an option on stocks or grains which allows the seller of the "put" to deliver to the buyer certain stocks or grain at a price stipulated some time before the transaction. The price named is generally much in favor of the seller and the option enables him to "put" the commodity to the purchaser at a price generally higher than the market figures. This transaction is at the option of the seller. "Calls" are options just the opposite to "puts," enabling the buyer to demand the delivery of the commodity from the seller, generally at a lower price than the market figure. This transaction is at the option of the buyer. A "pool" is an aggregation of speculators united to operate in certain stocks or commodities on exchanges. In railway circles a pool is a consolidation of interests by which certain earnings are made jointly by a number of roads and divided among the individual members of the pool at certain periods. The "curb" is a market for commodities not listed on a regular exchange. This term derives its name largely from the fact that such trading was originally done on the street curb. The "room trader" is a member of the exchange who buys and sells for himself more than for outside customers. A "corner" is a condition in the market when all the available supply of the article traded in, has been absorbed by a man or clique of men. This situation is generally brought on by very heavy short sales. The "shorts" can redeem their sales only from the crowd that has the "corner," who are invariably "bulls." The "bulls" then proceed to push the price up fabulously and the shorts must pay the difference between the price at which they sold and the price set at the will of the bulls. This condition often brings on a panic and sometimes results in the bankruptcy of the "shorts." It is no uncommon thing for the stock market to fluctuate violently on the merest rumor that tends toward financial depression. Because of this panicky feeling that often exists in the investing public, speculators often willfully set about to invent canards that will influence prices favorably to their operations. There are numerous other exchanges than that in Wall street, among which are those of Chicago and Philadelphia, the Mining Exchanges of Boston and Denver, and several other leading cities. In New Orleans, the Cotton Exchange is prominent for operations in the cotton market; the New York Cotton Exchange is also prominent in this trade. Of as much influence although of a different character, is that exerted by the Chicago Board of Trade, an exchange on which are regulated the prices of the grains and provisions of the world. This exchange is governed largely after the same manner as the New York Stock Exchange, excepting that the contracts made thereon are by members of the board for delivery of certain amounts of grains or provisions at certain specified times. This business is called trading in "futures" or making contracts for future delivery. At the outset it might be supposed that the future character of the transactions on the Chicago Board of Trade and the several boards of trades in the principal cities patterned after it, were purely of a gambling type. Such, however, is not necessarily the case.

Trading on the board of trade is done to a great extent in cash commodities, in which event the business is simply a purchase or sale similar to that over any counter. Purchases or sales for future delivery, however, are the life of the board, and constitute contracts for the delivery of grain before the last day of a specified month. The months of the greatest trading are those in which as a rule the grain of a harvest is most freely delivered, i. e., September and December for spring wheat, and May and July for winter wheat. Other months are traded in, but these show the largest transactions. Corn is dealt in most heavily in December, May and July. The contracts for these future deliveries are called "options." Sales for future delivery in almost every case are "short" sales. Occasionally, traders have the cash article in hand to deliver, and make sales for future delivery when prices are high. If prices fall off, the short accounts may be "covered" without regard to holdings in hand, or the holdings may be delivered on the contracts, which is the usual course of trading.

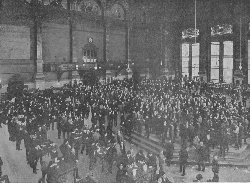

In the grain trade as well as in the stock market, there are in constant use a great number of odd phrases and signals, which mean much in great transactions, yet which convey little meaning to the public at large. Millions of dollars worth of grain change hands on the motion of a finger. Deals are turned by the quick fling of an arm, and in general, so staunch to a bargain are the operators that many a transaction is carried through to the end without a written agreement of any kind. The scene in the pits of the Chicago Board of Trade when this wild trading is in full swing, resembles a mob of men in a stampede, all with arms in air and with seemingly no way to take them down. 1Merchant ships in the carrying trade with the Orient discharging cargoes and refitting at Bremerton. The economy of sail power, particularly on trading voyages, still keeps in commission many vessels of motley types, from the modest fore-and-aft schooner to the "clipper built" ships, which were once the pride of America, and controlled the tea trade of the world. Return to text. INTERNATIONAL LAW |